By Michael DeCaluwe | December 26, 2022

When you hear about sustainability and ESG (Environmental, Societal, and Corporate Governance) measures, these are often associated with solar energy, RECs (Renewable Energy Certificates), or energy efficiency projects. Rightly so—these options are all effective at reducing an organization’s carbon footprint.

But if you take a deeper dive into what ESG is and how it’s measured, you can see why Renewable Natural Gas (RNG) is taking off in popularity.

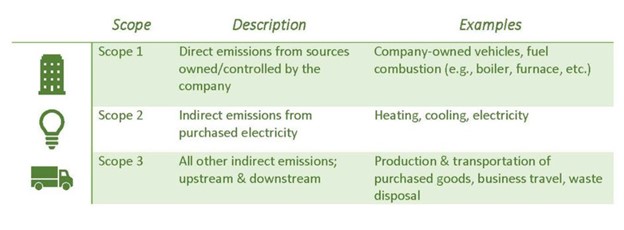

To understand why, it is first important to learn about ESG and how it is measured:

In short, Scope 1 emissions involve hydrocarbons that are burned onsite at a company’s dwelling (trucks, furnaces/boilers, etc.). Scope 2 is utility electricity, and Scope 3 is for upstream (a company’s suppliers) or downstream (how your product is used) emissions.

While ESG efforts have historically concentrated on reducing Scope 2, many in the ESG community are shifting focus to tackle Scope 1.

How Do You Reduce Scope 1 Emissions?

For those looking to reduce Scope 1 (natural gas) emissions, there are three primary avenues to do so:

- Energy Efficiency

- By upgrading HVAC equipment such as boilers and rooftop units (RTUs) with newer units that run more efficiently, energy users can reduce Scope 1 emissions since this newer equipment will utilize less natural gas.

- Purchase Carbon offsets

- In a newer and growing market, carbon offsets are a way to offset an organization’s carbon footprint. Offset units are generated by projects that reduce, reuse, or capture emissions. However, the offset market is newer and lacks standards. Offsets are not a direct Scope 1 reduction, but some would include them as an indirect one.

- Renewable Natural Gas (RNG)

- RNG is pipeline-quality natural gas that is derived from the decomposition of organic matter (landfills, wastewater treatment plants, ag waste digesters). RNG can either be piped from a gathering facility directly to a consumer or an energy user can purchase it as an RNG certificate, like a REC for power. Although RNG certificates are much more expensive than an offset, they do qualify as a Scope 1 carbon reduction.

There has been an explosion in the demand for RNG over the past few years, and the cost for RNG certificates has also skyrocketed. It is now roughly 3 times the cost of regular natural gas.

Despite that, demand for RNG continues to gain steam and will likely continue to do so as ESG and sustainability continue to gain traction.

Are you interested in learning more about RNG or how to reduce your ESG Scope Emissions? Feel free to reach out to one of our advisors!

Leave A Comment