- October 16, 2019

By Mike Eckenroth, CEM

What would you do with $70,000?

That’s the amount of overpaid taxes we helped a Baltimore condominium association identify and recover. They not only received a check for $70,000, but they also removed almost $20,000 in annual taxes from their forward budget.

When you’re looking for opportunities to save money on energy, reviewing your tax-exempt status is a great way to start.

Whose energy is tax exempt?

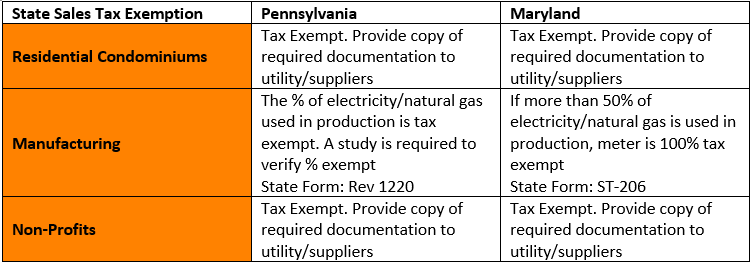

Nania Energy Advisors works with vetted tax firms to recover incorrectly paid taxes for our Mid-Atlantic clients. The table below displays some common electricity and natural gas tax exemptions we find every day for clients in Pennsylvania and Maryland.

See more about your state’s tax exemption classifications below.

Tax Exemptions in Maryland

Residential Condominiums

In Maryland, energy supplied and delivered to residential meters is tax exempt. This benefit also applies to common area meters (stairwells, hallways, etc.).

When common area meters are first installed, the utility categorizes them as commercial because they consume a lot of energy. Due to their commercial status, they are excluded from tax exemption.

However, those common area meters are extensions of residential meters. Since they are used for residential purposes, they usually qualify for the same tax exemptions as residential meters.

Manufacturing

Utilities and fuels used predominantly and directly for production activities in Maryland are tax exempt. Energy used in non-production activities like storage and administration is not.

When energy comes through the same meter for both taxable and exempt uses, taxability is determined by majority usage. If more than half of the meter’s energy is used for production, then the entire meter is tax exempt.

Tax Exemptions in Pennsylvania

Residential Condominiums

Residential meters in Pennsylvania are tax exempt for energy delivery and supply. TaxMatrix describes this exemption as follows:

“Utilities (steam, natural gas, manufactured gas, electricity, bottled gas, fuel oil, and kerosene) are exempt from Pennsylvania sales and use tax when purchased by a residential purchaser solely for the purchaser’s own residential use.

The term includes use or consumption by a condominium association or housing cooperative that acts on behalf of residents who are using the units as their personal residences.”

Manufacturing

Energy used for production in Pennsylvania is tax exempt. Non-production activities are taxable.

When it come to dual-purpose meters, the Pennsylvania law differs from the Maryland law.

When utilities are sold through a single meter for both taxable and exempt uses, taxability is controlled by percentage usage. Only the portion of energy used in production is exempt.

To make this determination easier on yourself, work with a tax recovery firm to have a study conducted on your meter. This study will tell you how much of the meter’s energy is exempt.

Nonprofit Organizations

Nonprofits should not be taxed for electricity and natural gas.

Nonprofits include, but are not limited to:

- Churches

- Hospitals

- Educational institutions

- Federal credit unions

- Social welfare organizations

“I think I’m tax exempt. What should I do next?”

Just because you may qualify for an exemption doesn’t mean you automatically receive it.

Work with your accounting team or a tax recovery firm to:

- Verify your tax-exempt status

- Assess if you’re being charged state taxes

- Determine if you should be getting charged

- Take necessary action to remove the taxes and recover a refund.

As part of your energy strategy discussion, your energy advisor can guide you to tax experts for exemption verification. Contact us to review your organization’s exemption status.

**DISCLAIMER**

Nania Energy Advisors is not a licensed tax professional, and this article does not constitute tax advice. Tax exemption benefits are unique to each business. Any action you take to manage your exemption status after reading this should be verified with a licensed tax professional before implementation. Nania Energy Advisors assumes no liability.

About the Author

Mike is a Senior Strategic Energy Advisor and Certified Energy Manager based out of  Baltimore, Maryland, with a strong engineering and purchasing background. His specialties include energy efficiency and strategic commodity procurement. Growing up in the shadow of Three Mile Island nuclear power plant, Mike has an intimate stake in a grid with safe, reliable, and cost-effective energy generation — which he leverages into an energy strategy that provides security for his clients.

Baltimore, Maryland, with a strong engineering and purchasing background. His specialties include energy efficiency and strategic commodity procurement. Growing up in the shadow of Three Mile Island nuclear power plant, Mike has an intimate stake in a grid with safe, reliable, and cost-effective energy generation — which he leverages into an energy strategy that provides security for his clients.

You can reach Mike at (443) 833-8224 or meckenroth@naniaenergy.com.